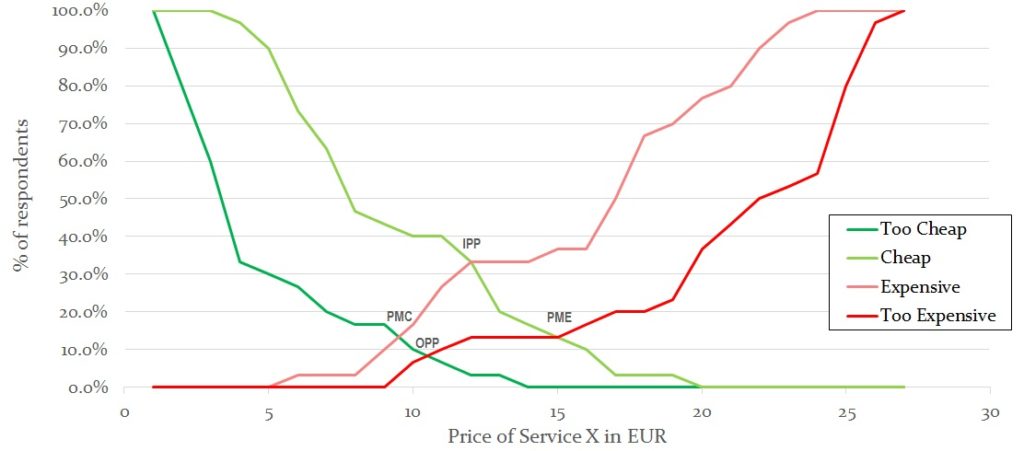

The VW analysis consists in computing the cumulative (expensive and too expensive) and retro-cumulative (cheap and too cheap) frequencies of these four price distributions and plotting the results on a line chart.

The van Westendorp Price Sensitivity Meter (PSM or VW) is used for determining consumer price preferences as it allows a good understanding of customers’ price elasticity.

The general explanation of the four intersecting frequencies varies. However, the most common interpretation is the following:

- PMC – intersection of the too cheap and expensive lines: lower bound for an acceptable price range; it is also referred to as Point of Marginal Cheapness, e.g. the price point below which sales would be lost because quality is questionable;

- PME – intersection of the too expensive and cheap lines: upper bound for an acceptable price range; it is also referred to as Point of Marginal Expensiveness, e.g. the price point above which cost is a serious concern;

- IPP – intersection of the expensive and cheap lines: it is the price at which an equal number of respondents rate the price point as either cheap or expensive; it is also referred to as Indifference Price Point;

- OPP – intersection of the too expensive and too cheap lines: it is the price at which an equal number of respondents rate the price point as either too cheap or too expensive and thus describe the price as exceeding either the lower or upper limits; it is also referred to as Optimal Price Point.

The prices between the PMC and the PME define what is usually referred to as Range of Acceptable Pricing.

The function traditional.VW available in R-sw Pricing provides the traditional VW analysis as described above, including the price elasticity chart which allows identifying the four key intersection points and the range of acceptable pricing.